Menu

Finance

ESSER III

- ESSER III Uses of Funds Plan

- ESSER III Return to In-Person Instruction and Continuity of Services Plan

- ESSER III Expenditure Report Reimbursement

Financial Transparency

91͵ĹÄ is at the forefront of financial transparency among school districts. We have been awarded numerous awards for Financial Transparency throughout the years. Most recently, 91͵ĹÄ was awarded a Transparency Star in both Traditional Finances and Debt Obligations from the state comptroller. 91͵ĹÄ takes a great deal of pride in it’s Financial Transparency and will continue to remain diligent in it’s communication of district finances.

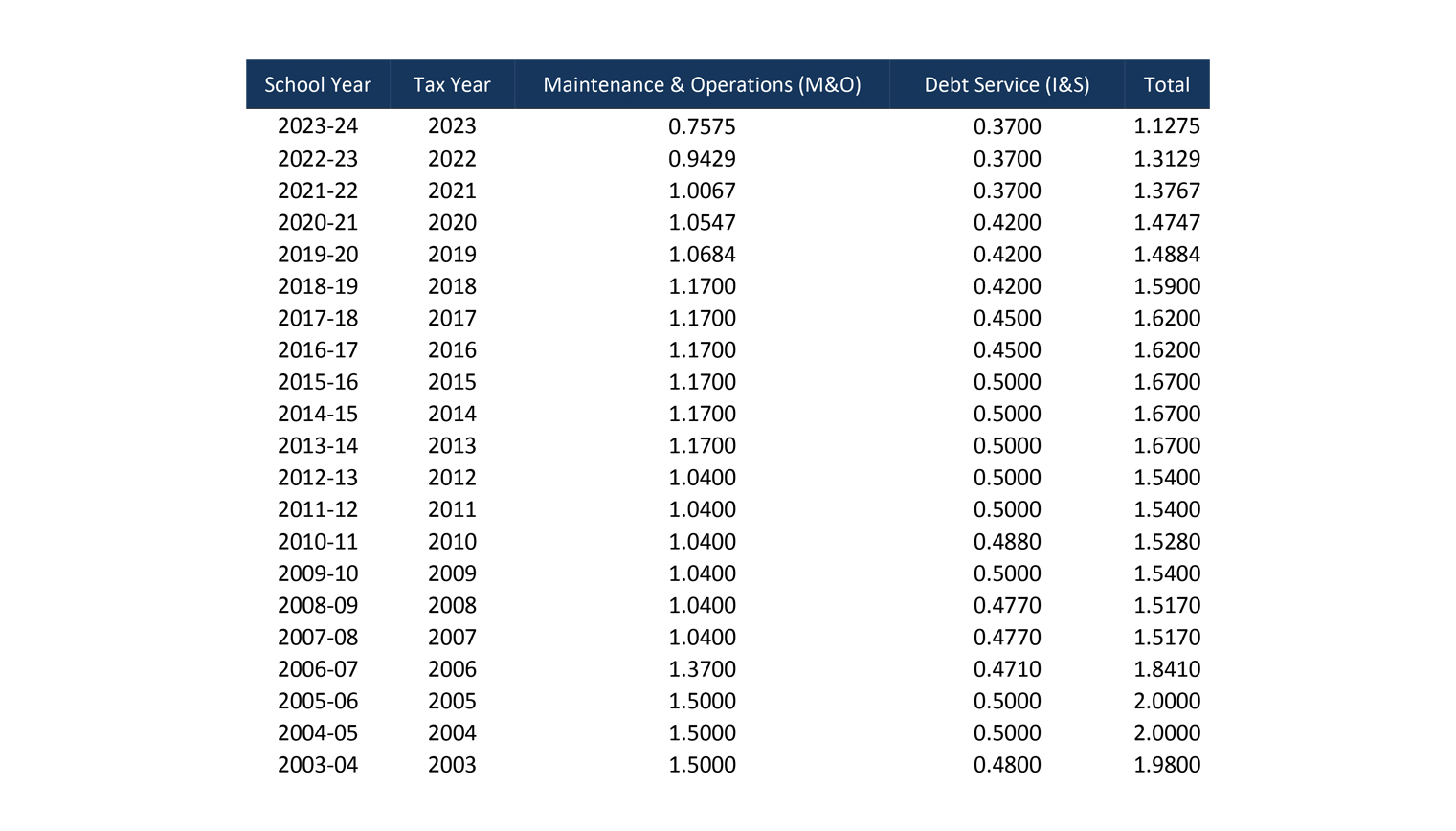

Current Tax Rate

2023 adopted tax rate is $1.1275 per $100 valuation. The combined tax rate is a combination of an M&O tax rate of $0.7575 and an I&S tax rate of $0.3700.

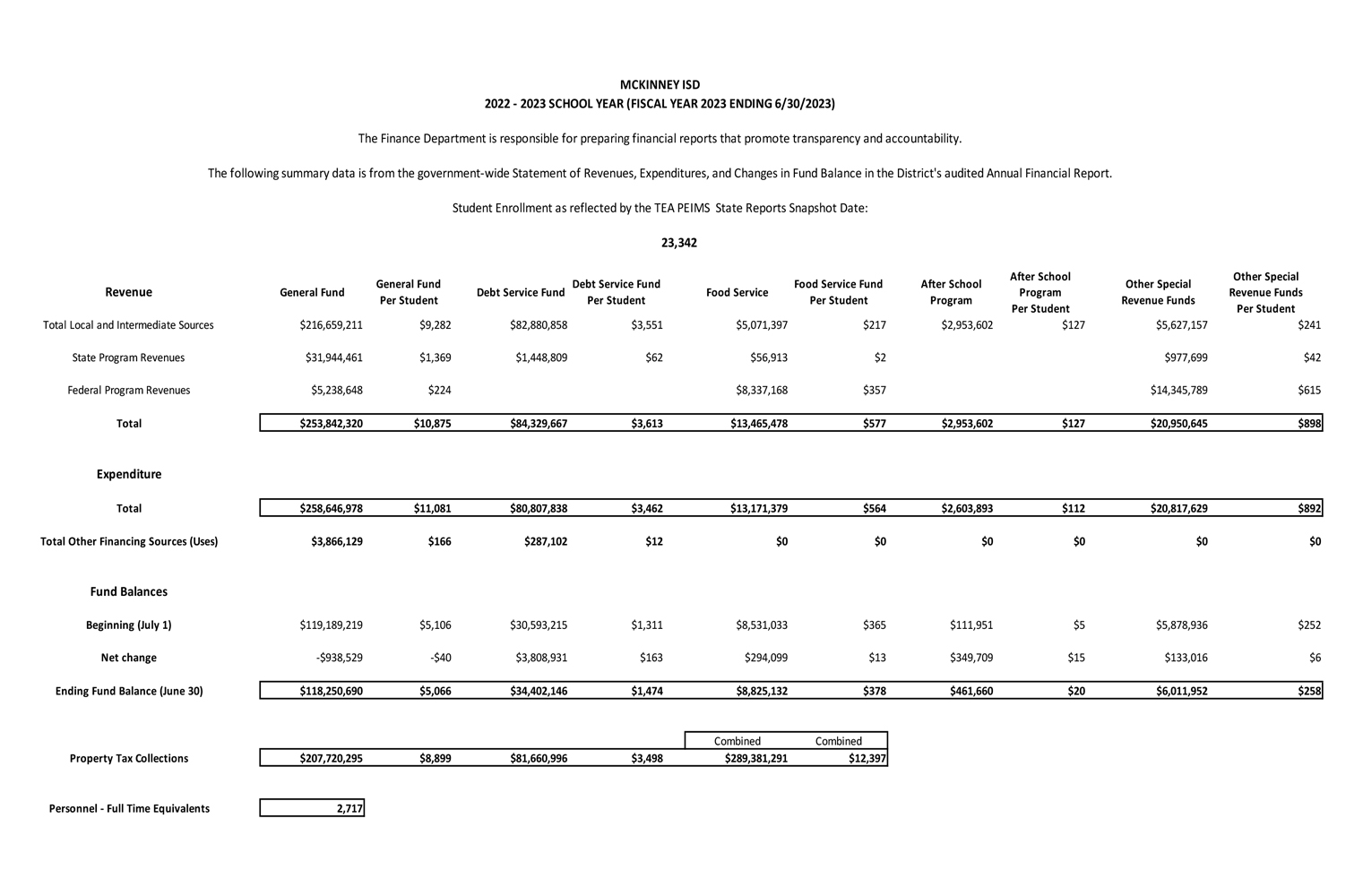

2022-23 School Year [Fiscal Year 2023 Ending 6/30/23]

The above summary data is from the government-wide Statement of Revenues, Expenditures, and Changes in Fund Balance in the District’s audited Annual Financial Report.

2022-23 School Year (PDF)

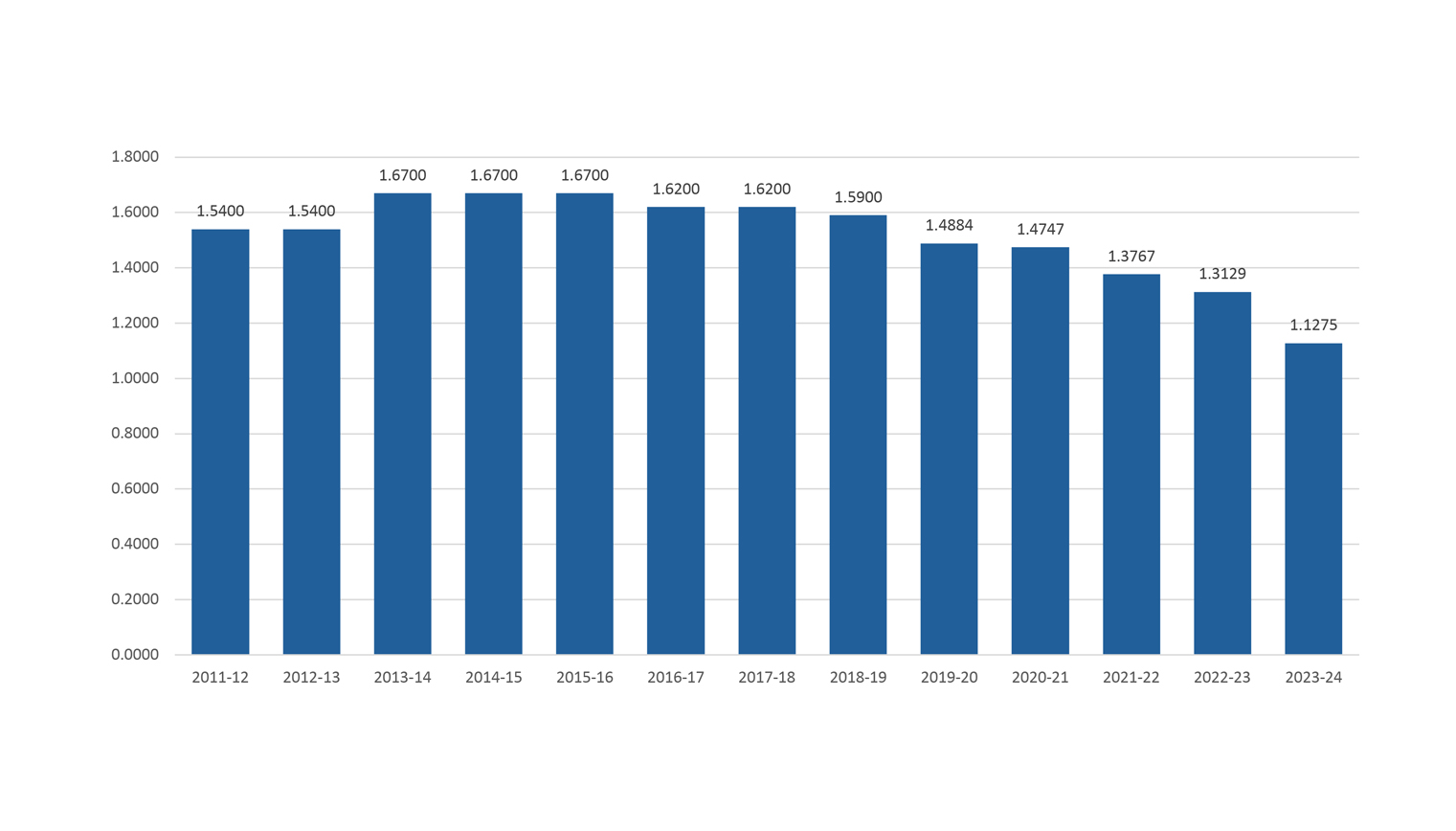

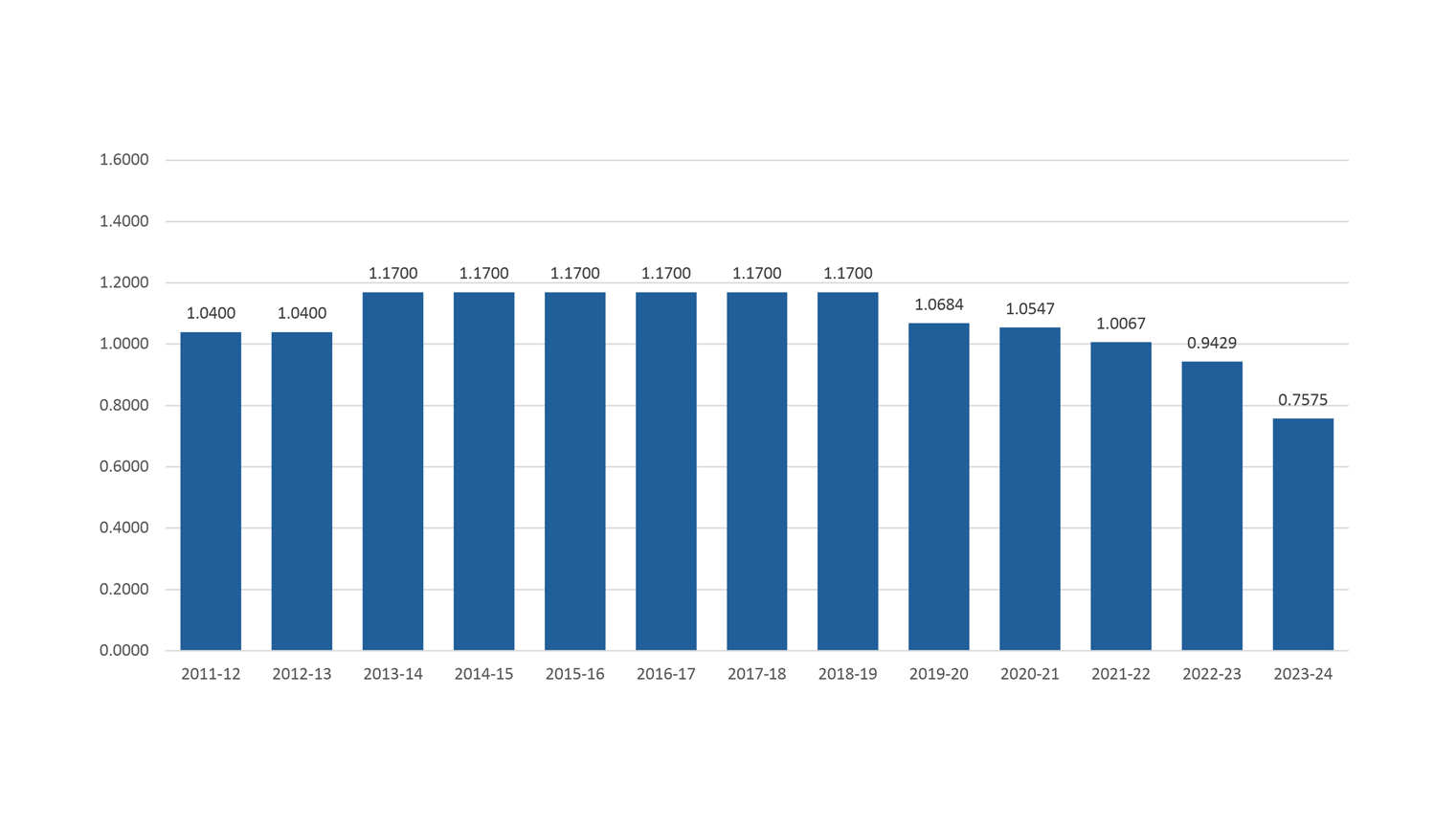

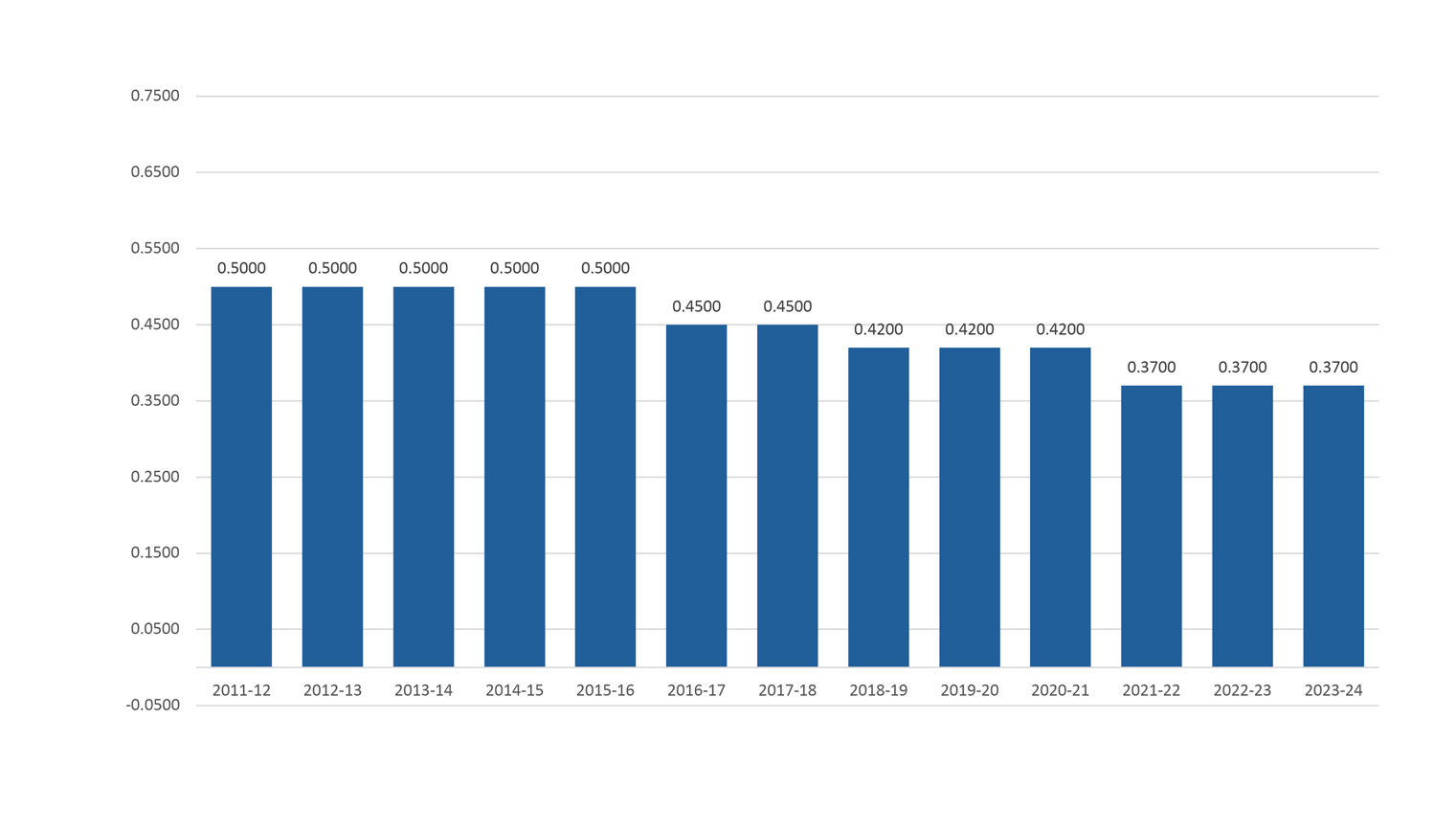

Historic Tax Rate Comparison

Total Property Tax per $100 Valuation

Maintenance & Operating (M&O) Property Tax per $100 Valuation

Interest & Sinking (I&S) Property Tax Per $100 Valuation

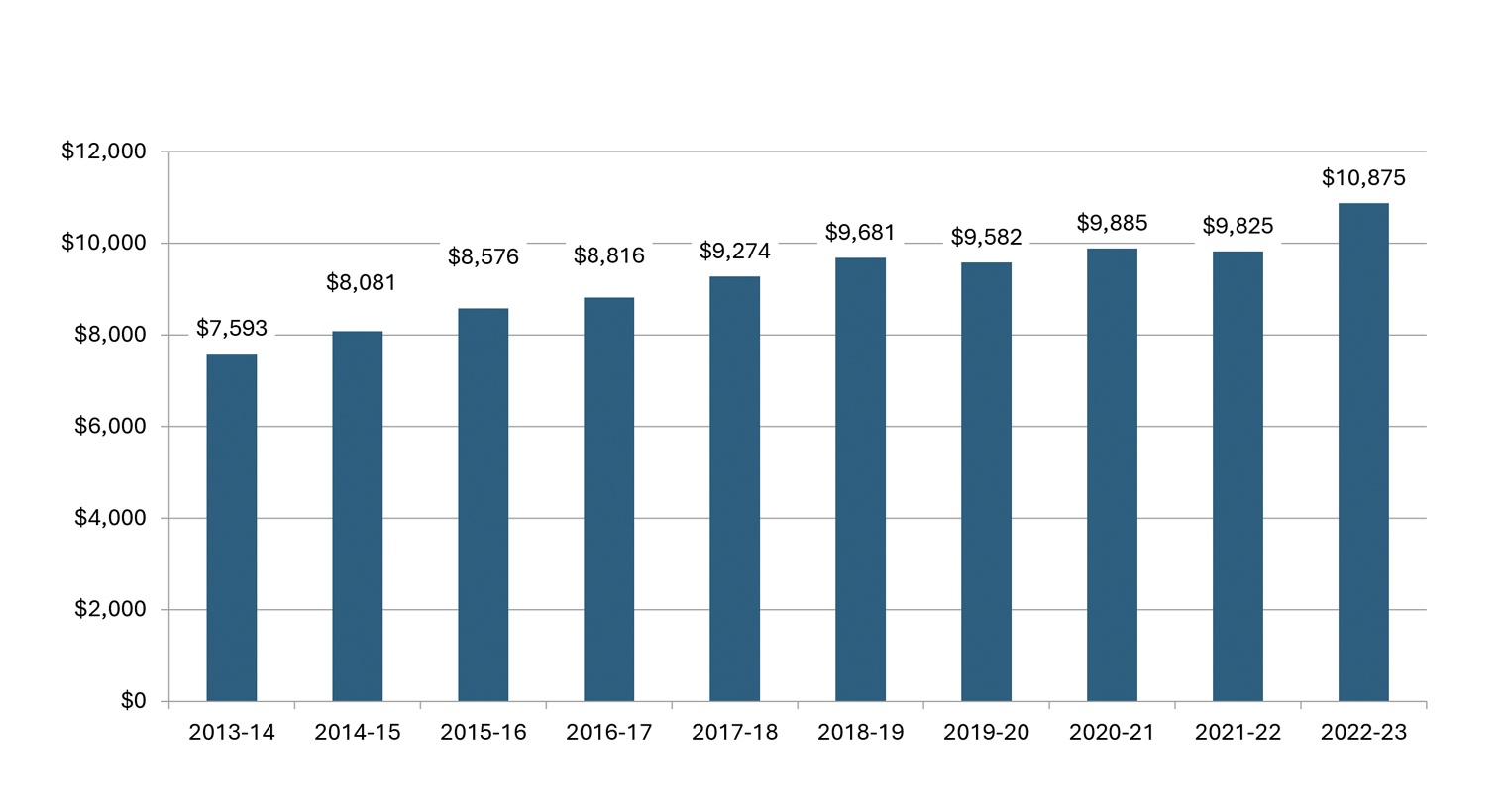

General Fund Revenues Per Student

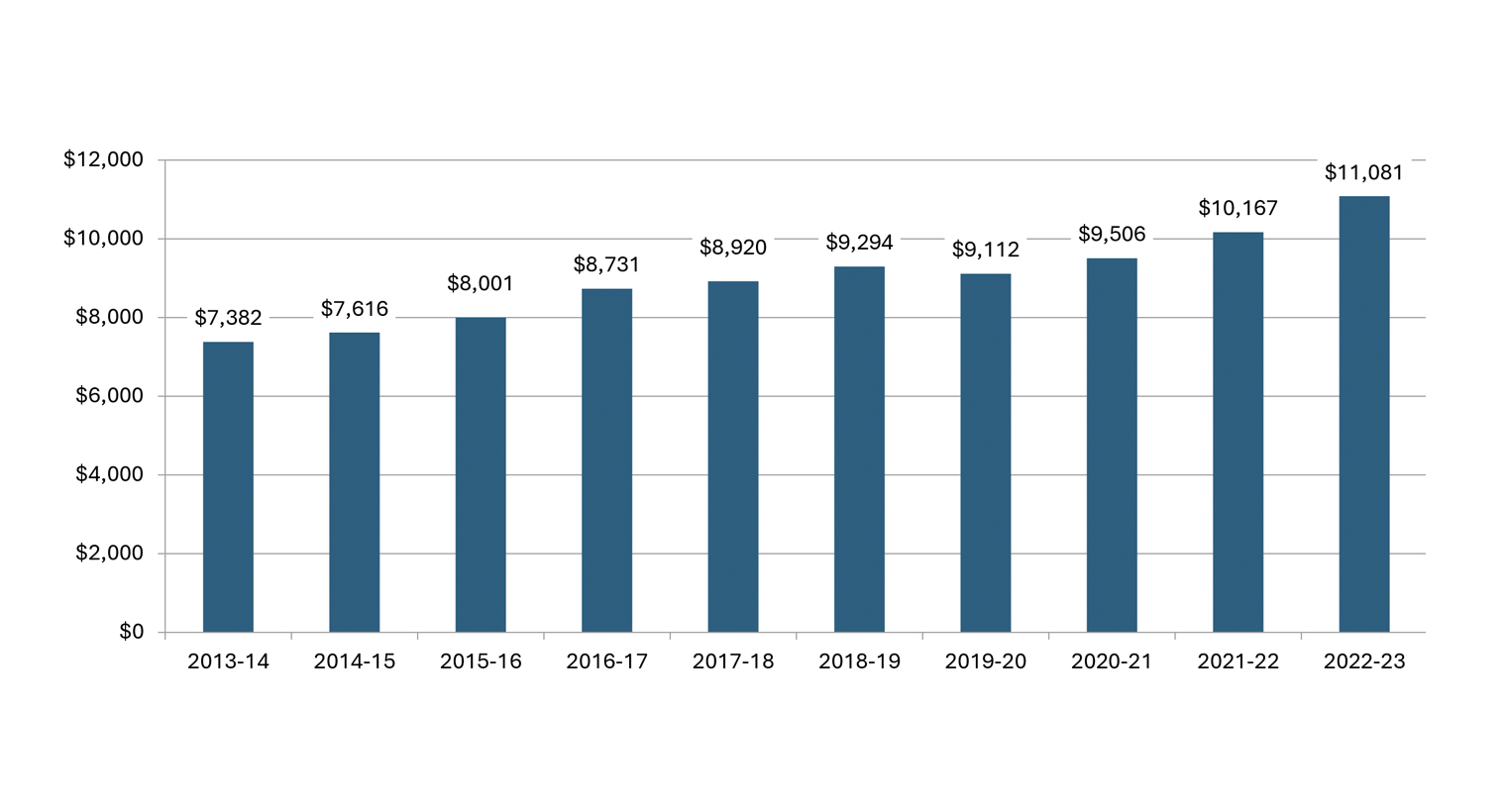

General Fund Expenditures Per Student

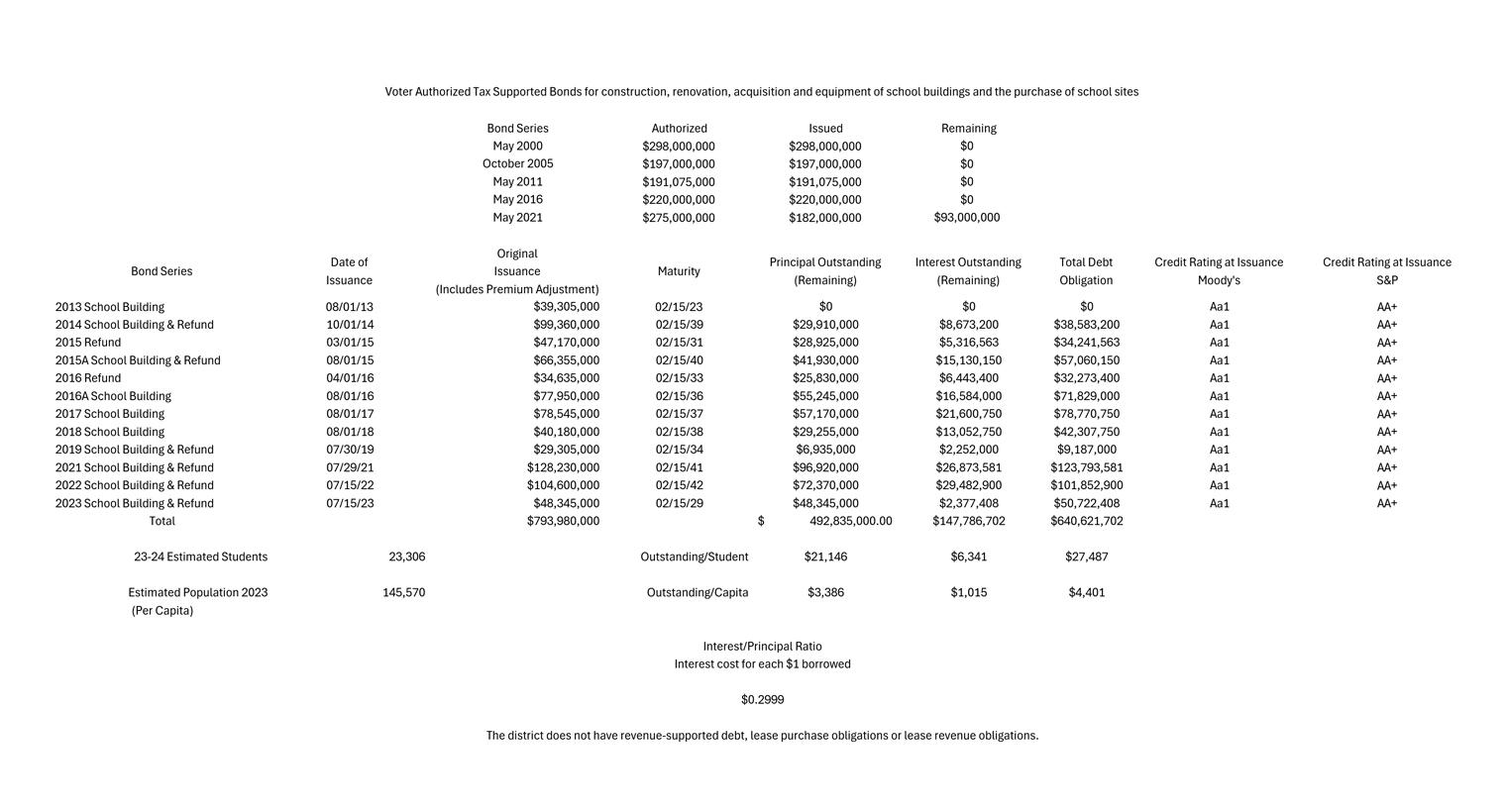

Debt Service Requirements as of 7/15/23

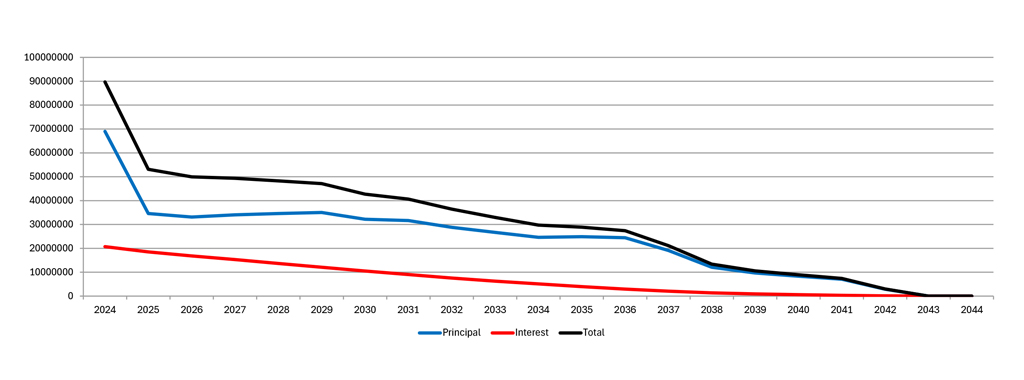

Debt Service Requirements

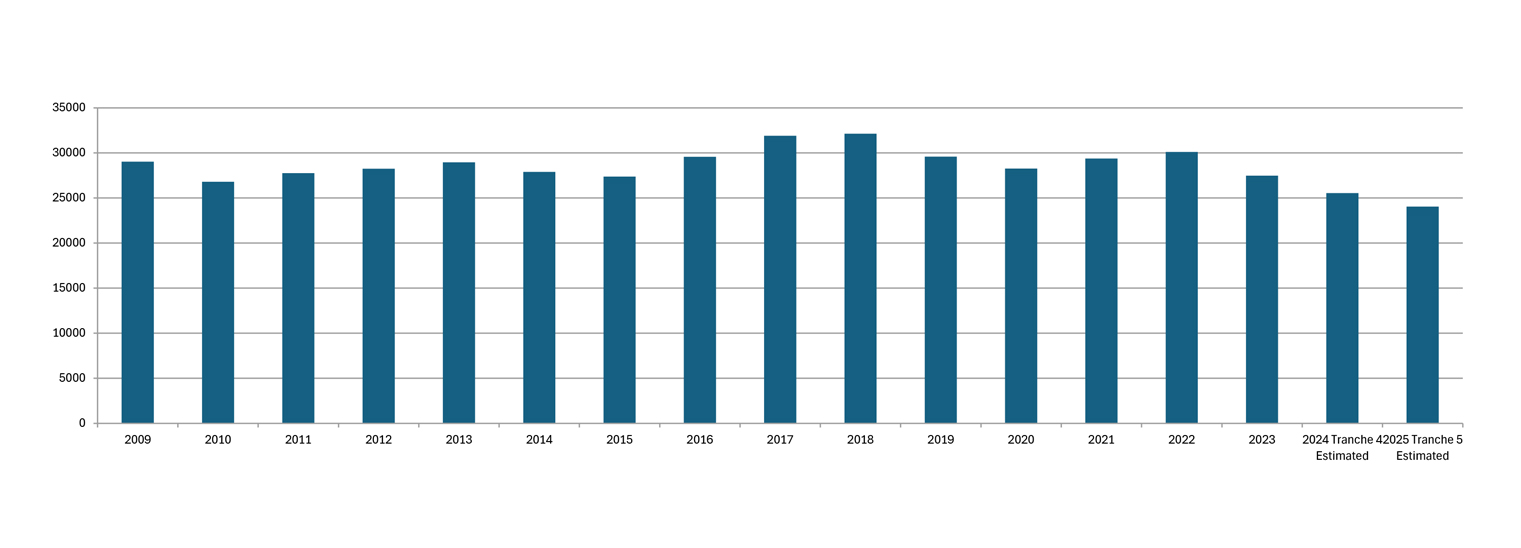

Tax Supported Debt Per Student

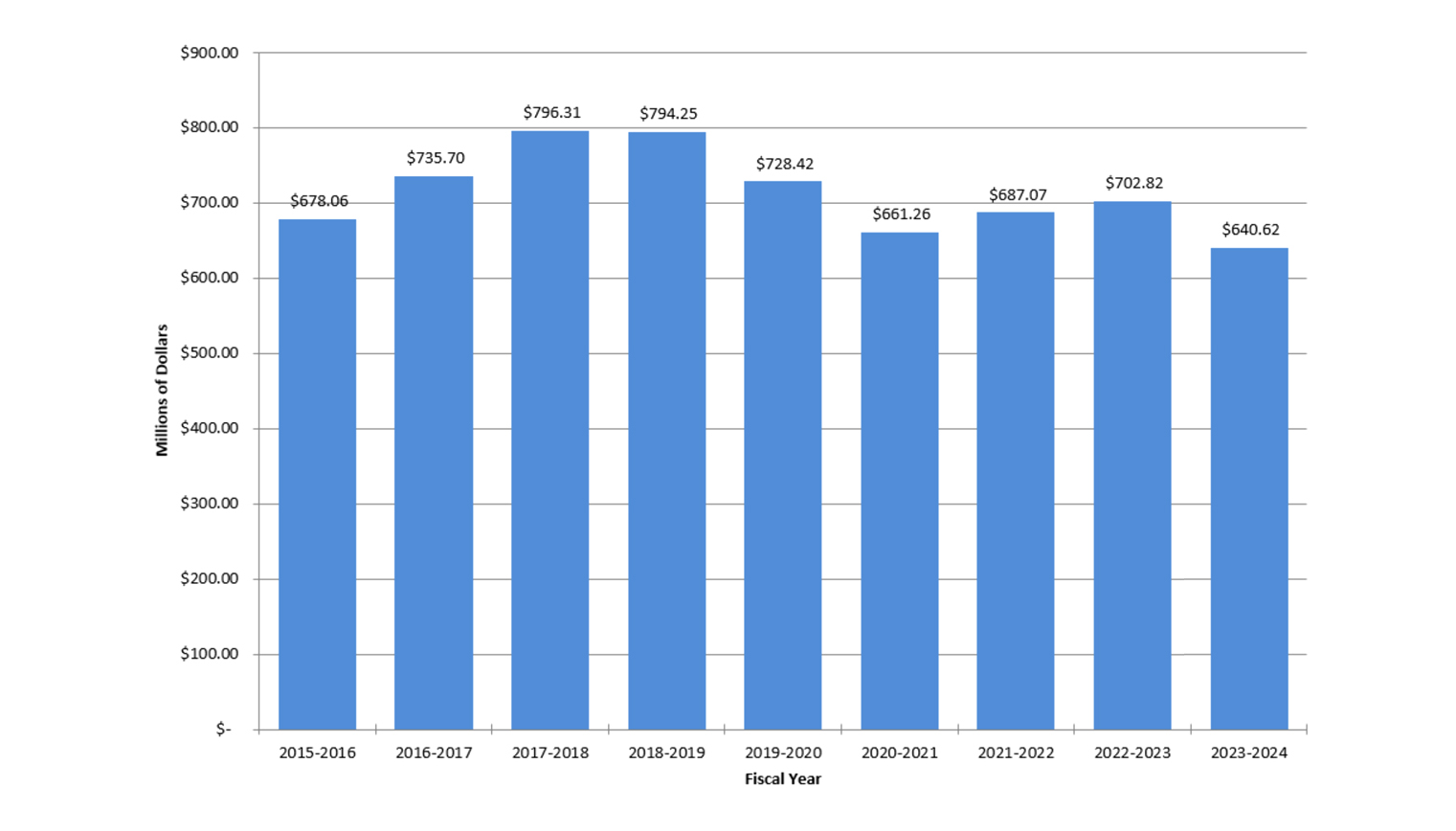

Tax Supported Debt (in Millions)

Debt Information

Indep. Registered Municipal Advisor Certificate

Audited Financial Statements

- 2022-2023 Audited Financial Statement

- 2021-2022 Audited Financial Statement

- 2020-2021 Audited Financial Statement

- 2019-2020 Audited Financial Statement

- 2018-2019 Audited Financial Statement

- 2017-2018 Audited Financial Statement

- 2016-2017 Audited Financial Statement

- 2015-2016 Audited Financial Statement

- 2014-2015 Audited Financial Statement

- 2013-2014 Audited Financial Statement

- 2012-2013 Audited Financial Statement

- 2011-2012 Audited Financial Statement

- 2010-2011 Audited Financial Statement

- 2009-2010 Audited Financial Statement

- 2008-2009 Audited Financial Statement

- 2007-2008 Audited Financial Statement

- 2006-2007 Audited Financial Statement

Financial Integrity Rating System of Texas (FIRST)

- 2022-2023 Financial Integrity Rating System of Texas (FIRST)

- 2021-2022 Financial Integrity Rating System of Texas (FIRST)

- 2020-2021 Financial Integrity Rating System of Texas (FIRST)

- 2019-2020 Financial Integrity Rating System of Texas (FIRST)

- 2018-2019 Financial Integrity Rating System of Texas (FIRST)

- 2017-2018 Financial Integrity Rating System of Texas (FIRST)

- 2016-2017 Financial Integrity Rating System of Texas (FIRST)

- 2014-2015 Financial Integrity Rating System of Texas (FIRST)

- 2011-2012 Financial Integrity Rating System of Texas (FIRST)

- 2010-2011 Financial Integrity Rating System of Texas (FIRST)

- 2009-2010 Financial Integrity Rating System of Texas (FIRST)

- 2008-2009 Financial Integrity Rating System of Texas (FIRST)

- 2007-2008 Financial Integrity Rating System of Texas (FIRST)

Budget/Taxes

- 2023-24 Adopted Budget

- 2023-24 Adopted Budget

- 2023-24 Proposed Budget

- 2023-24 Proposed Budget

- 2023-24 Budget Historical Comparison

- 2022-23 Budget Historical Comparison

- 2022-23 Adopted Budget

- 2022-23 Adopted Budget

- 2022-23 Proposed Budget

- 2022-23 Proposed Budget

- 2021-22 Adopted Budget

- 2021-22 Adopted Budget

- 2021-22 Budget Historical Comparison

- 2021-22 Budget Narrative

- 2021-22 Proposed Budget

- 2021-22 Proposed Budget

- 2020-21 Adopted Budget

- 2020-21 Adopted Budget

- 2020-21 Budget Narrative

- 2020-21 Budget Historical Comparison

- 2019-20 Adopted Budget

- 2019-20 Adopted Budget

- 2019-20 Budget Historical Comparison

- 2019-20 Budget Narrative

- 2019-20 Proposed Budget

- 2019-20 Proposed Budget

- 2018-19 Adopted Budget

- 2018-19 Adopted Budget

- 2018-19 Budget Narrative

- 2018-19 Budget Historical Comparison

- 2018-19 Proposed Budget

- 2018-19 Proposed Budget

- 2017-18 Adopted Budget

- 2017-18 Adopted Budget

- 2017-2018 Budget Narrative

- 2017-2018 Budget Historical Comparison

- 2017-2018 Proposed Budget

- 2017-2018 Proposed Budget

- 2016-2017 Adopted Budget

- 2016-2017 Budget Narrative

- 2016-2017 Budget Historical Comparison

- 2016-2017 Proposed Budget

- 2016-2017 Proposed Budget

- 2015-2016 Adopted Budget

- 2015-2016 Adopted Budget

- 2015-2016 Budget Narrative

- 2015-2016 Proposed Budget

- 2014-2015 Adopted Budget

- 2014-2015 Adopted Budget

- 2014-2015 Budget Narrative

- 2013-2014 Adopted Budget

- 2013-2014 Adopted Budget

- 2013-2014 Budget Narrative

- 2012-2013 Adopted Budget

- 2012-2013 Adopted Budget

- 2011-2012 Adopted Budget

- 2011-2012 Adopted Budget

- 2010-2011 Adopted Budget

- 2010-2011 Adopted Budget

- 2009-2010 Adopted Budget

- 2008-2009 Adopted Budget

- 2007-2008 Adopted Budget

Budget Books

Bond Reports

91͵ĹÄ has no scheduled upcoming bond elections at this time.

- 2021 Bond Program Report (January 2024)

- 2016 Bond Program Report (January 2024)

- 2021 Bond Program Report (December 2023)

- 2016 Bond Program Report (December 2023)

- 2021 Bond Program Report (November 2023)

- 2016 Bond Program Report (November 2023)

- 2021 Bond Program Report (October 2023)

- 2016 Bond Program Report (October 2023)

- 2021 Bond Program Report (September 2023)

- 2016 Bond Program Report (September 2023)

- 2021 Bond Program Report (August 2023)

- 2016 Bond Program Report (August 2023)

- 2021 Bond Program Report (July 2023)

- 2016 Bond Program Report (July 2023)

- 2021 Bond Program Report (June 2023)

- 2016 Bond Program Report (June 2023)

- 2021 Bond Program Report (May 2023)

- 2016 Bond Program Report (May 2023)

- 2021 Bond Program Report (April 2023)

- 2016 Bond Program Report (April 2023)

- 2021 Bond Program Report (March 2023)

- 2016 Bond Program Report (March 2023)

- 2021 Bond Program Report (February 2023)

- 2016 Bond Program Report (February 2023)

- 2021 Bond Program Report (January 2023)

- 2016 Bond Program Report (January 2023)

- 2021 Bond Program Report (December 2022)

- 2016 Bond Program Report (December 2022)

- 2021 Bond Program Report (November 2022)

- 2016 Bond Program Report (November 2022)

- 2021 Bond Program Report (October 2022)

- 2016 Bond Program Report (October 2022)

- 2021 Bond Program Report September (2022)

- 2016 Bond Program Report September (2022)

- 2021 Bond Program Report (August 2022)

- 2016 Bond Program Report (August 2022)

- 2021 Bond Program Report (July 2022)

- 2016 Bond Program Report (July 2022)

- 2021 Bond Program Report (May 2022)

- 2021 Bond Program Report (April 2022)

- 2021 Bond Program Report (March 2022)

- 2021 Bond Program Report (February 2022)

- 2021 Bond Program Report (January 2022)

- 2021 Bond Program Report (December 2021)

- 2021 Bond Program Report (November 2021)

- 2021 Bond Program Report (October 2021)

- 2021 Bond Program Report (September 2021)

- 2016 Bond Program Report (May 2022)

- 2016 Bond Program Report (April 2022)

- 2016 Bond Program Report (March 2022)

- 2016 Bond Program Report (February 2022)

- 2016 Bond Program Report (January 2022)

- 2016 Bond Program Report (December 2021)

- 2016 Bond Program Report (November 2021)

- 2016 Bond Program Report (October 2021)

- 2016 Bond Program Report (September 2021)

- 2016 Bond Program Report (August 2021)

- 2016 Bond Program Report (July 2021)

- 2016 Bond Program Report (May 2021)

- 2016 Bond Program Report (April 2021)

- 2016 Bond Program Report (March 2021)

- 2016 Bond Program Report (February 2021)

- 2016 Bond Program Report (January 2021)

- 2016 Bond Program Report (December 2020)

- 2016 Bond Program Report (November 2020)

- 2016 Bond Program Report (October 2020)

- 2016 Bond Program Report (September 2020)

- 2016 Bond Program Report (August 2020)

- 2016 Bond Program Report (July 2020)

- 2016 Bond Program Report (May 2020)

- 2016 Bond Program Report (April 2020)

- 2016 Bond Program Report (March 2020)

- 2016 Bond Program Report (February 2020)

- 2016 Bond Program Report (January 2020)

- 2016 Bond Program Report (December 2019)

- 2016 Bond Program Report (November 2019)

- 2016 Bond Program Report (October 2019)

- 2016 Bond Program Report (September 2019)

- 2016 Bond Program Report (August 2019)

- 2016 Bond Program Report (July 2019)

- 2016 Bond Program Report (June 2019)

- 2016 Bond Program Report (May 2019)

- 2016 Bond Program Report (April 2019)

- 2016 Bond Program Report (March 2019)

- 2016 Bond Program Report (February 2019)

- 2016 Bond Program Report (January 2019)

- 2016 Bond Program Report (December 2018)

- 2016 Bond Program Report (November 2018)

- 2016 Bond Program Report (October 2018)

- 2016 Bond Program Report (September 2018)

- 2016 Bond Program Report (August 2018)

- 2016 Bond Program Report (July 2018)

- 2016 Bond Program Report (June 2018)

- 2016 Bond Program Report (May 2018)

- 2016 Bond Program Report (April 2018)

- 2016 Bond Program Report (March 2018)

- 2016 Bond Program Report (February 2018)

- 2016 Bond Program Report (January 2018)

- 2016 Bond Program Report (December 2017)

- 2016 Bond Program Report (August 2017)

- 2016 Bond Program Report (September 2017)

- 2016 Bond Program Report (November 2017)

- 2011 Bond Program Report (August 2017)

- 2011 Bond Program Report (September 2017)

- 2011 Bond Program Report (November 2017)

- 2000 Bond Program Report (Final)

- Energy Board Report

Manuals

- 91͵ĹÄ Grant Policies and Procedures Manual

- Student Activity Manual

- Accounting and Purchasing Manual

Other

- BSG Organizational Chart

- Financial Fraud Hotline

- Internet Fundraising

- Annual Investment Report

- Quarterly Investment Report

- Board Members

- S. Pratt – Superintendent Contract

- S. Pratt – 2024 Contract Amendment

Information Requests

Email your request including your name, mailing address, phone number and a list of requested documents to [email protected].

Office of Business & Finance

#1 Duvall Street

McKinney, Texas 75069

469-302-4131